Santa Ana, California, United States

350 4-barrel V8

Automatic

32700

1977

Tewksbury, Massachusetts, United States

5.7 350 ci

Automatic

20000

1977

Antioch, Illinois, United States

5.3 LS

Automatic

120000

1986

Milton, New York, United States

455

Automatic

68000

1972

Canton, Ohio, United States

350

Automatic

80000

1975

Hickory, North Carolina, United States

—

Automatic

57920

1977

Naples, Florida, United States

3.8l V6

Automatic

7968

1983

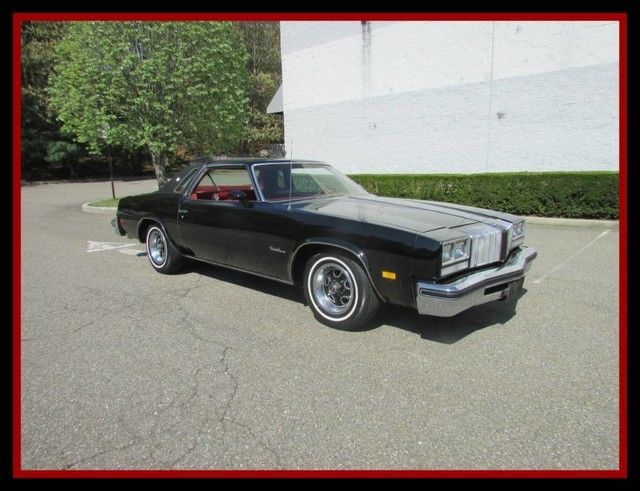

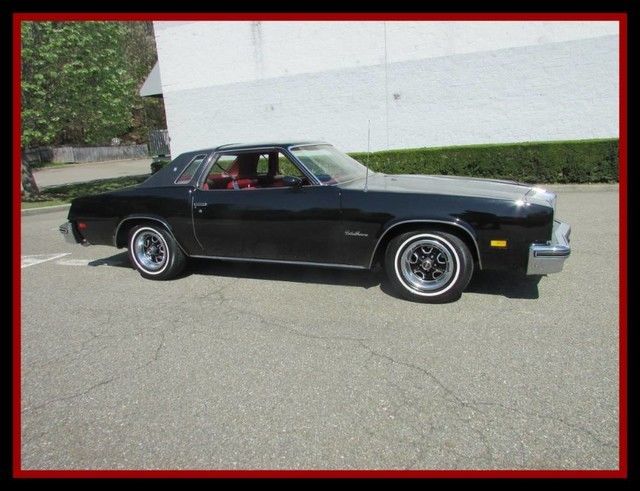

Pasadena, California, United States

—

Automatic

40836

1977

Smithtown, New York, United States

--

Automatic

36,607

1977

Nazareth, Pennsylvania, United States

5.7L 350Cu. In. V8 GAS OHV Naturally Aspirated

—

129,000

1977