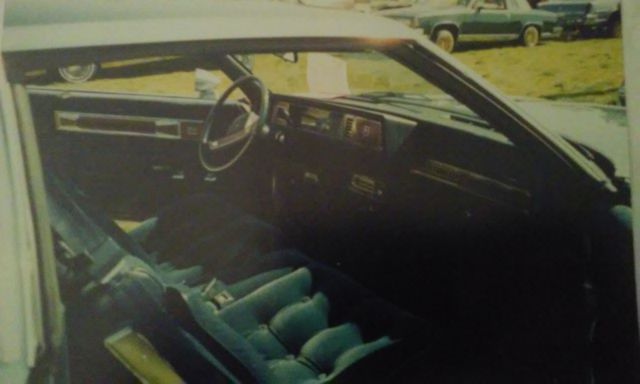

1985 oldsmobile cutlass supreme one of a kind

| Make: |

Oldsmobile |

| Model: |

Cutlass |

| Type: |

Coupe |

| Year: |

1985 |

| Mileage: |

0085000 |

| VIN: |

1g3gm47y6fr341879 |

| Color: |

Blue |

| Engine: |

v8 |

| Cylinders: |

8 |

| Fuel: |

Gasoline |

| Transmission: |

Automatic |

| Drive type: |

RWD |

| Interior color: |

Blue |

| Vehicle Title: |

Clear |

| Item location: |

Van Nuys, California, United States |

1985 Oldsmobile Cutlass Additional Info:

i have all the parts all the crome has been repolished and the rest is stilll in gm packeging,all it needs is a paint job a vinyl top snd a headliner because i put a power sun roof and they flinged the metal so its like its factory,beutifull car i wish i can keep it ive hade it for 20 years its 1985,but everything is updated to 1987 i have not turned it on for almost 3 years it also needs a battery thats all,i would like it to go to movie studio or a collector thank you!!!